How to Manage Employee Deductions

Overview

This guide walks you through creating, updating, viewing, and deleting employee deductions within the Payroll Workspace. You’ll learn how to set up a deduction category, create a new employee deduction, and manage existing deductions efficiently.

Prerequisites

- Access to the Payroll workspace platform

- Admin or authorized permissions to manage payroll data

- A deduction category created in the Settings page

When You Need This

- Applying statutory or custom deductions to employee salaries (e.g., pension, loans, fines)

- Updating the details of an existing deduction (e.g., amount or category)

- Removing deductions that are no longer applicable

Step-by-Step Instructions

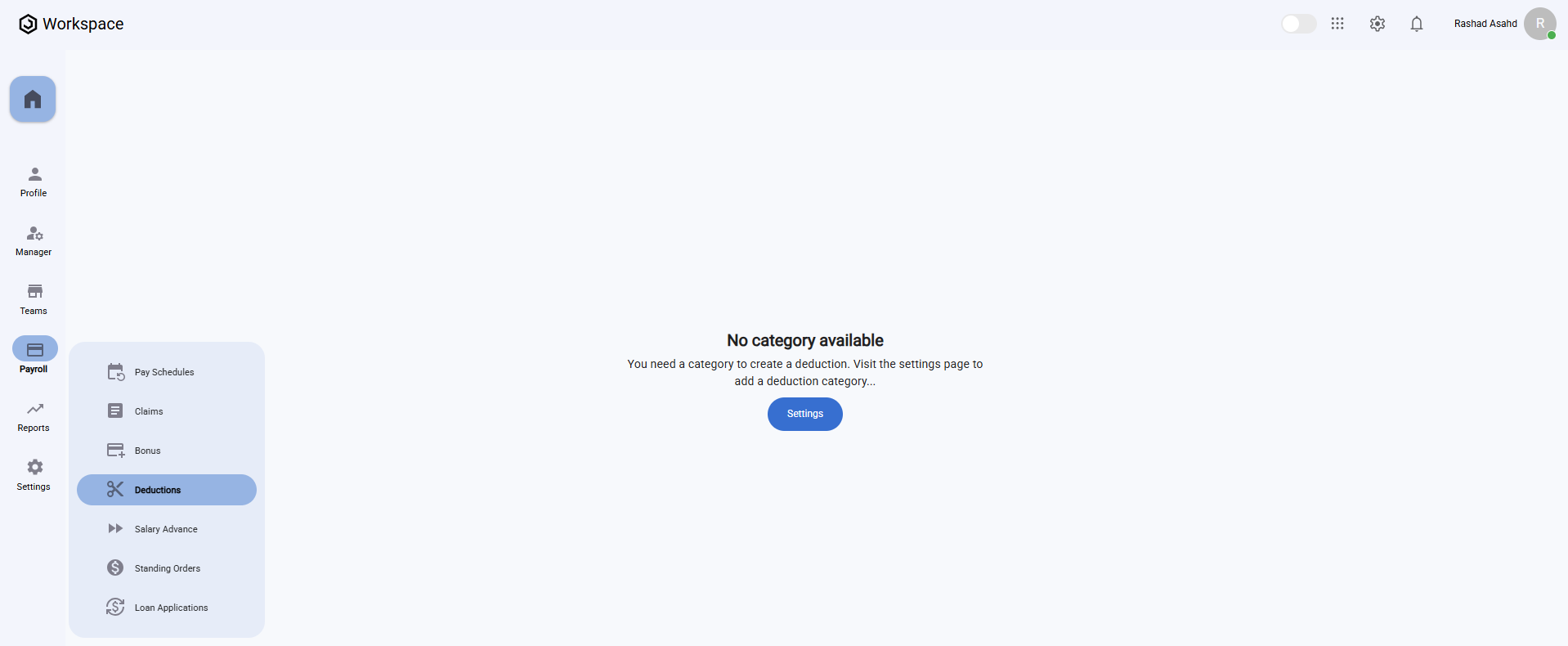

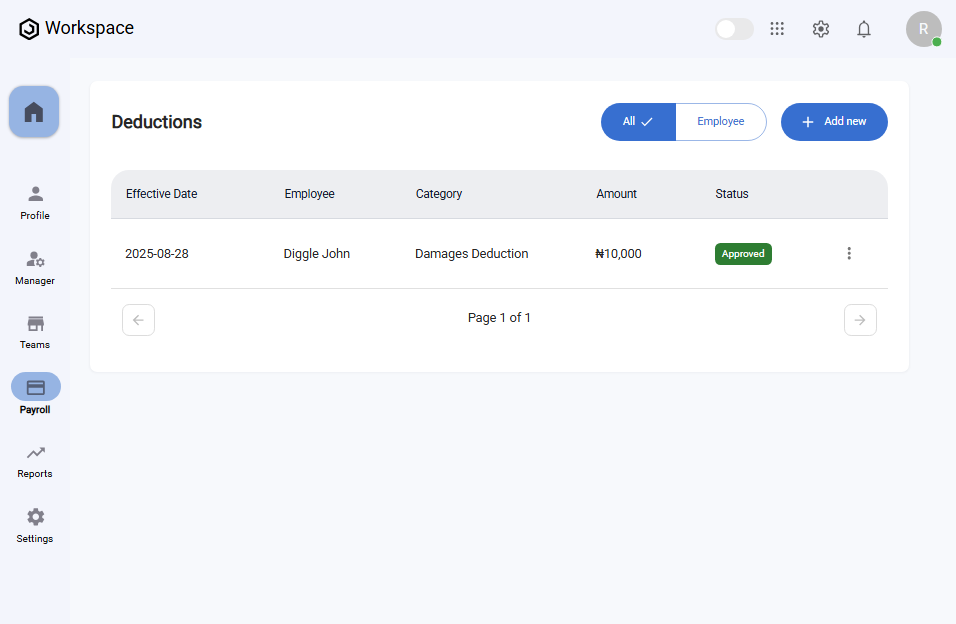

Step 1: Access the Deduction Page

- Log into your Organogram Payroll workspace at

payroll.organogram.app. - From the left-hand sidebar, click "Payroll".

- Under the Payroll section, select "Deduction".

⚠️ If you don’t have a deduction category, click the "Settings" button on the Deduction page or click on settings from the left sidebar to create one before proceeding.

- After creating a deduction category, an employee deduction can then be created.

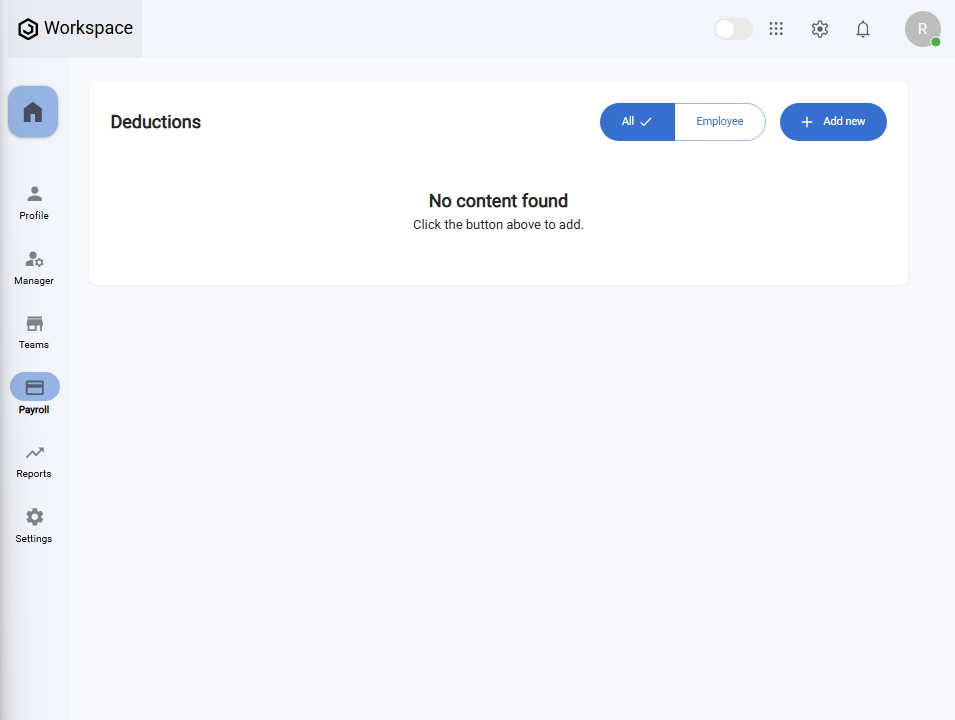

Step 2: Create a New Employee Deduction

- On the Deduction page, click the "Add New" button.

- The "Add Deduction" form will appear.

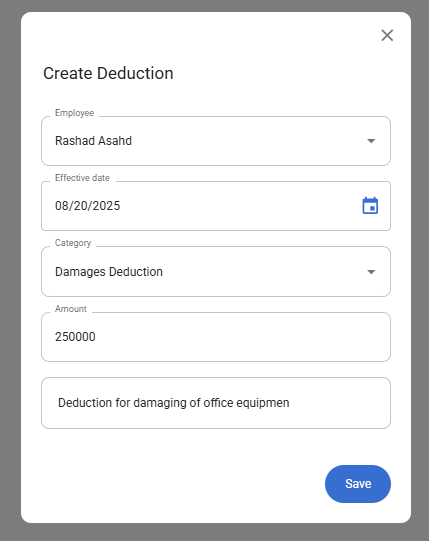

Fill in the following fields:

- Employee – Select the employee for whom the deduction applies (dropdown list).

- Effective Date – Choose the date using the datepicker for when the deduction takes effect.

- Category – Select the deduction category (must be created beforehand).

- Amount – Enter the deduction amount.

- Remarks – Add any notes or comments.

- After filling in the information, click the "Save" button.

- A notification will appear: "Deduction created successfully".

- The newly added deduction will now display in the Deduction Table.

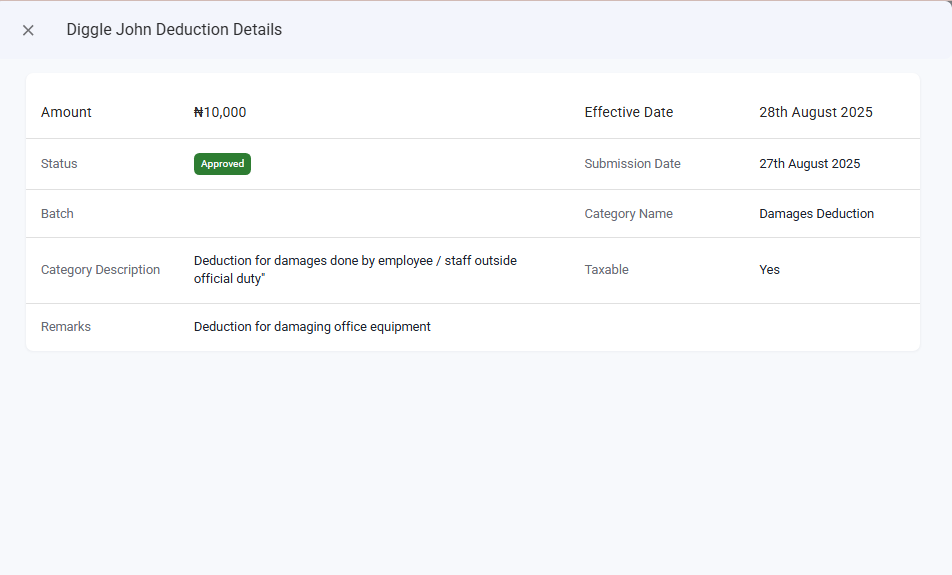

Step 3: View an Employee Deduction

- Locate the deduction you wish to view in the Deduction Table.

- Click the three-dot menu icon (⋮) on the right-hand side of the deduction row.

- Select "View".

- A full-screen details dialog will open, displaying all deduction information including:

- Amount

- Effective Date

- Status

- Submission Date

- Batch

- Category Name

- Category Description

- Taxable

- Remarks

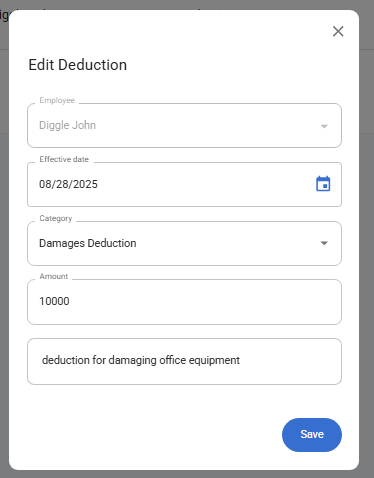

Step 4: Edit an Employee Deduction

- Locate the deduction you wish to edit in the Deduction Table.

- Click the three-dot menu icon (⋮) on the right-hand side of the deduction row.

- Select "Edit".

- The Edit Deduction form will appear, pre-filled with the current details.

- Update the necessary fields (e.g., amount, category, or remarks).

- Click "Save".

- A confirmation notification will appear: "Deduction updated successfully".

Note: The employee initially selected cannot be changed during editing. Only other details such as Effective Date, Category, Amount, and Remarks can be updated.

Step 5: Delete an Employee Deduction

- In the Deduction Table, click the three-dot menu icon (⋮) on the deduction entry you want to remove.

- Select "Delete".

- A confirmation dialog will appear asking if you’re sure.

- Click "Yes" to confirm.

- The deduction will be deleted, and a notification will appear: "Deduction deleted successfully".